How to fill in my tax declaration using the Selma tax statement

Is it free?

Yes. The tax report is included in the Selma fee and does not cause you any additional costs.

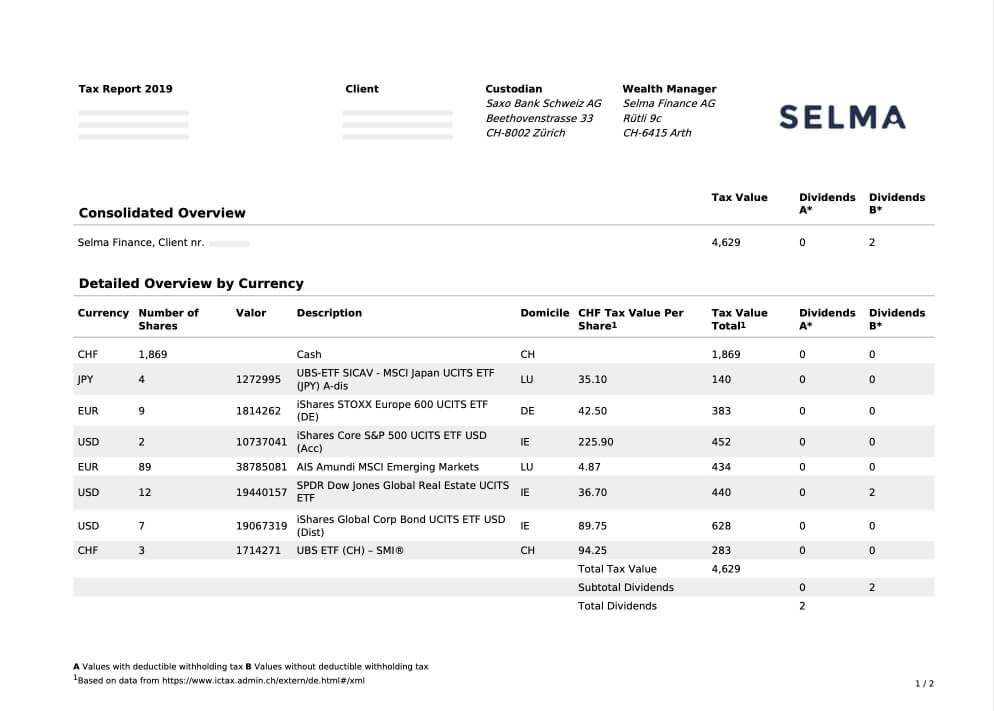

How does it look?

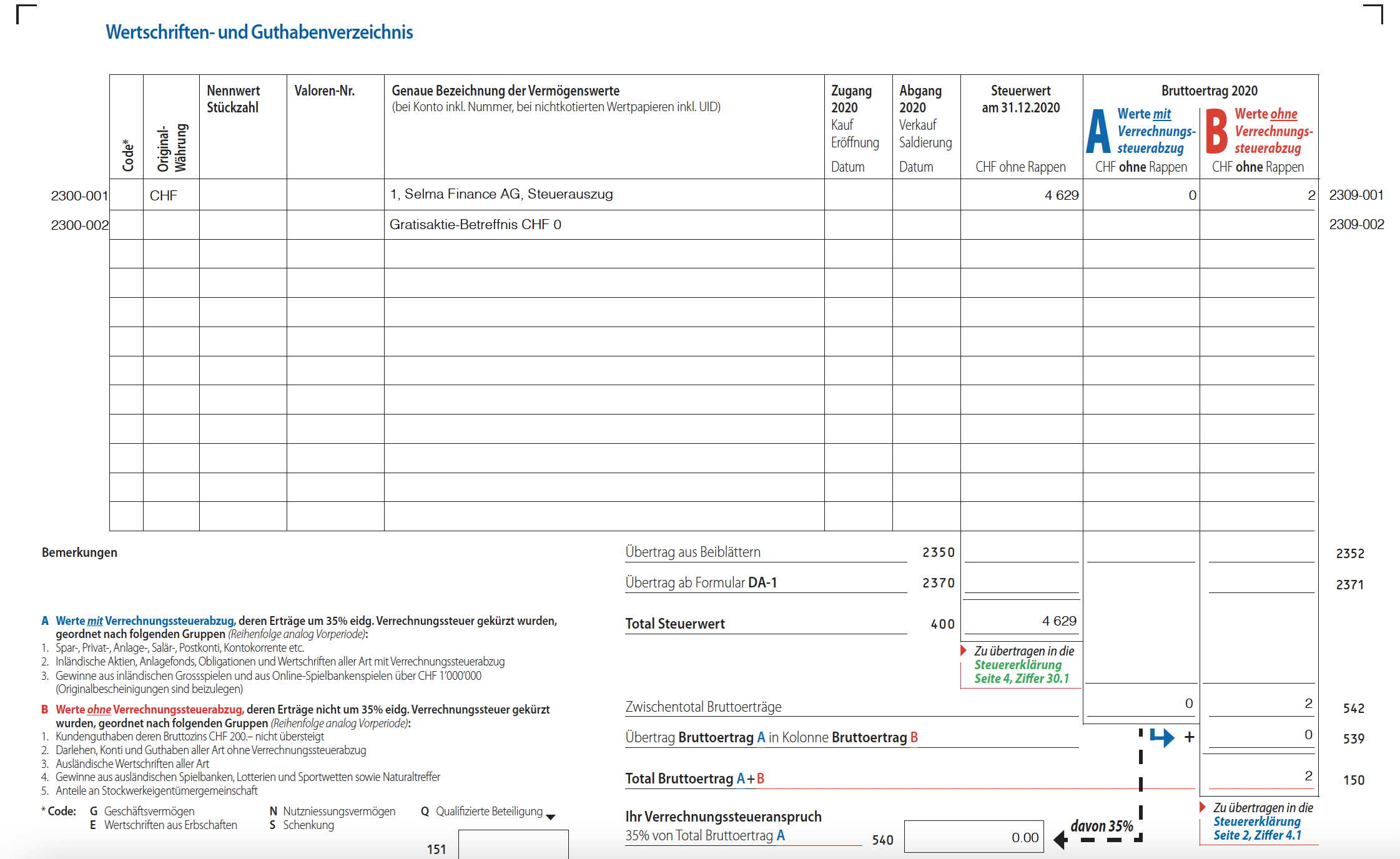

Here's an example of how your tax report would look:

When will it be ready?

Selma creates two tax reports, one in mid-January and one in March. Always with the numbers available on that date. You can always use the current document to fill out your tax declaration.

The various ETFs (funds) in which you are invested must report their annual income to the responsible tax authority (ESTV) so that the tax authority can account for the interests correctly.

Some ETFs share their data with the tax authorities at the beginning of the year and others only later in the year. Most ETFs release their final numbers by March.

It may be that an ETF does not report its figures until later, which will subsequently lead to changes from the tax authorities.

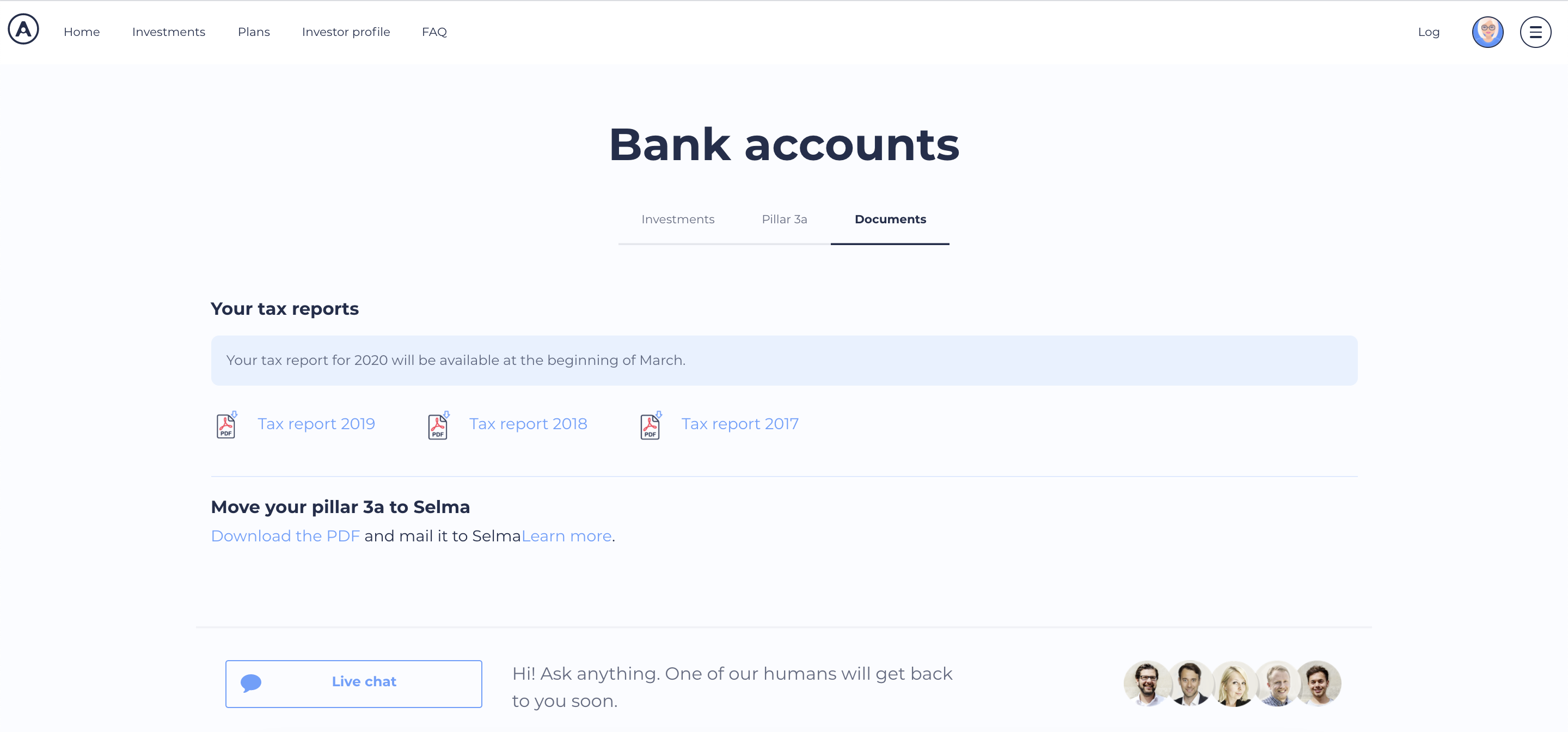

How can I get it?

You will get an email as soon as it is ready. You can then simply download the report:

- 💻 from the web app: go to “Bank accounts” – “Documents”.

- 📱 from the mobile app: go to “More” – “Documents”.

How to fill out the tax declaration

This is how you add your Selma tax report info to your tax declaration form. You need to declare your Selma tax report in the form "Wertschriften- und Guthabenverzeichnis" of your tax declaration. There you have to select an account type/statement category, these are called slightly differently in each canton. For the Selma tax report, please select one of the following options, or something similar:

- Tax statement

- Depot statement

- Tax-assessed depot statement

- Tax register

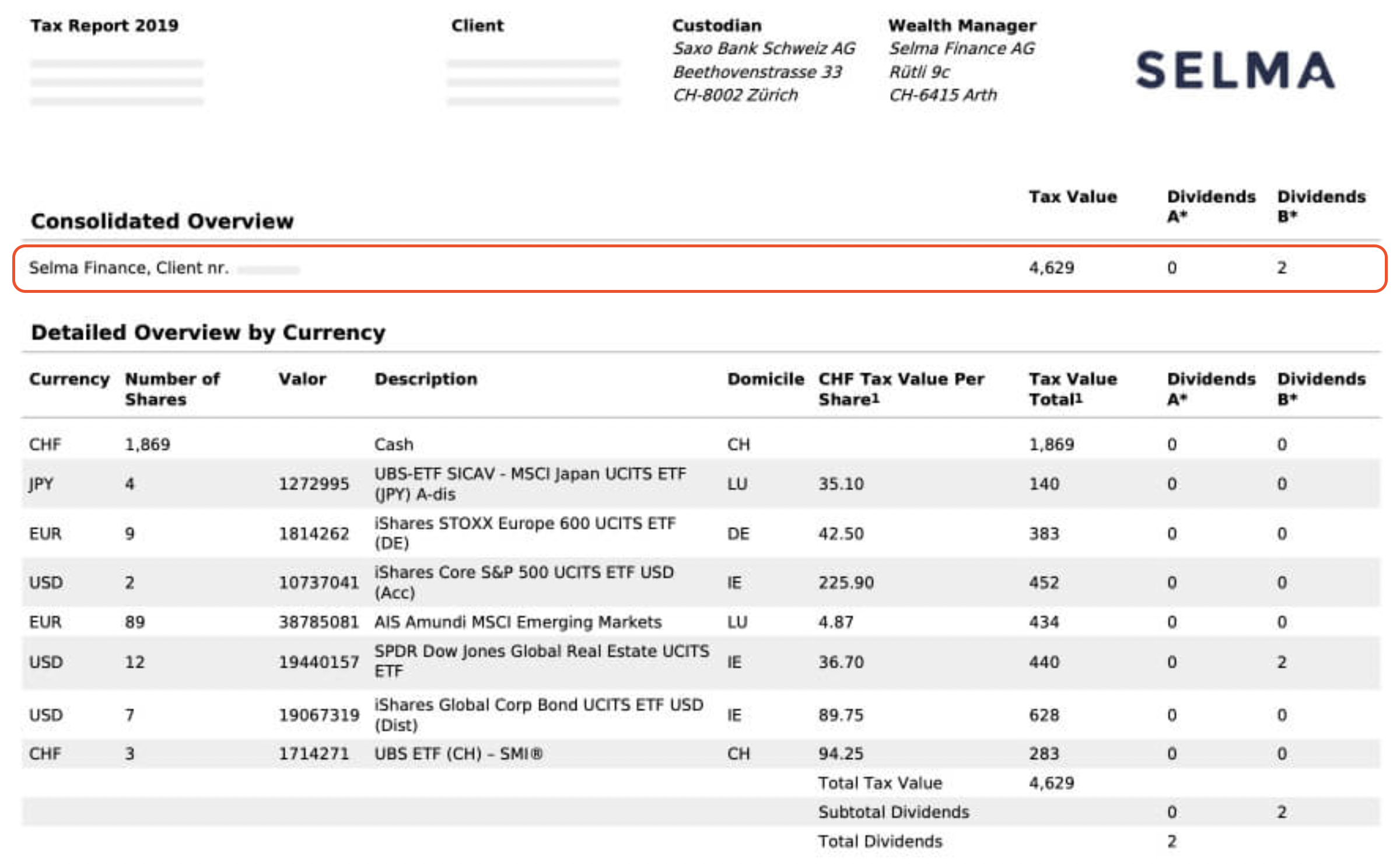

As an example, let's look at the 2019 version of Selma's tax report. The most important information first: You do not need to transfer all the data provided Selma's tax report to your "Wertschriften- und Guthabenverzeichnis", you only need to transfer one row, the one on the top. 👍

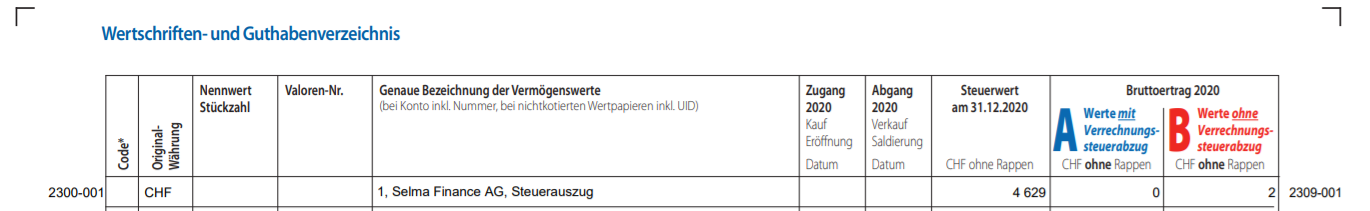

In the screenshot below, you see the exact part of your declaration in which you add the information of your Selma report in your tax declaration. It's in the form called "Wertschriften- und Guthabenverzeichnis".

This is how the entire form looks like after you have added the data from Selma's tax report:

Don't forget to deduct the cost for your wealth management:

No matter who is taking charge of managing your wealth (the bank, Selma, etc.), you can deduct the costs from the tax. In some cantons there is a flat sum of around 0,2 - 0,4 promille, in others you have to effectively calculated the costs.

As mentioned, Selma as your wealth manager (or investment assistant) also falls into this category. Read here more about it.

Can I get a tax report for another country?

If you need a tax report for another country please let us know, so we can check if it is available.